Quick Ratio Acid Test Formula Example Calculation

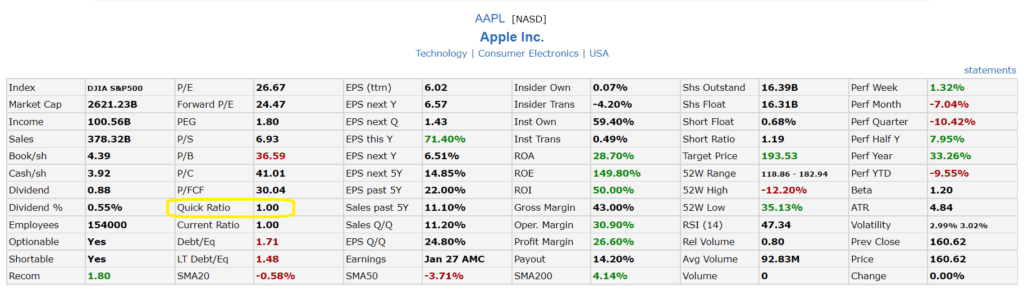

However, a quick ratio of less than 1 indicates that the company may have problems meeting its short-term obligations without having to sell some of its larger assets. While a high Quick Ratio indicates strong liquidity, it may also suggest that the company is not efficiently using its assets. It’s essential to consider industry norms and the company’s specific circumstances. A Quick Ratio of 1.0 or higher is generally considered healthy, indicating a company can meet its short-term obligations without selling inventory.

Is there any other context you can provide?

- Let’s be honest - sometimes the best quick ratio calculator is the one that is easy to use and doesn’t require us to even know what the quick ratio formula is in the first place!

- The ideal liquidity ratio for your small business will balance a comfortable cash reserve with efficient working capital.

- This result indicates that the company has $1.11 in liquid assets for every $1 of current liabilities, suggesting strong liquidity.

- The quick ratio is a more conservative measure of liquidity than the current ratio.

- Since it indicates the company’s ability to instantly use its near-cash assets (assets that can be converted quickly to cash) to pay down its current liabilities, it is also called the acid test ratio.

The Quick Ratio cannot be negative, as it represents a ratio of assets to liabilities. If liabilities exceed liquid assets, the ratio will be less than 1, but not negative. Yes, a very high quick ratio may indicate that a company is not efficiently using its assets, potentially hoarding cash instead of investing in growth. The turbotax offers discount higher the quick ratio, the more financially stable a company tends to be, as you can use the quick ratio for better business decision-making. The quick ratio only considers readily available assets which means it cannot be used by companies that have significant amounts of fixed assets such as real estate or equipment.

What is a company’s quick ratio?

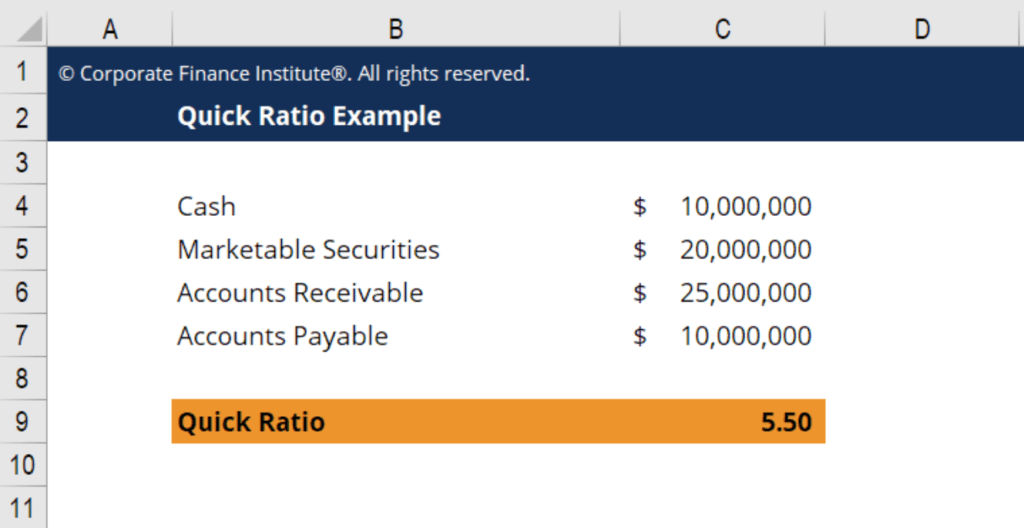

Cash equivalents are often an extension of cash, as this account often houses investments with very low risk and high liquidity. The Quick Ratio does not account for the timing of cash flows or the quality of receivables. It also assumes that all current liabilities are due immediately, which may not be the case.

Examples of QR calculations

It’s also known as the acid-test ratio and is worth learning—no matter your industry. The quick ratio helps you track your liquidity, which is your ability to pay bills in the short term. Using the quick ratio can help you avoid cash flow problems and maintain good relationships with your creditors and suppliers. The acid test ratio measures the liquidity of a company by showing its ability to pay off its current liabilities with quick assets. If a firm has enough quick assets to cover its total current liabilities, the firm will be able to pay off its obligations without having to sell off any long-term or capital assets. The quick ratio is sometimes confused with the current ratio.

Formula For Quick Ratio

The quick ratio considers only assets that can be converted to cash in a short period of time. The current ratio, on the other hand, considers inventory and prepaid expense assets. The quick ratio (acid-test ratio) is a simple indicator used to measure the ability of a company to meet its short-term obligations with its most liquid assets. In other words, the quick ratio allows you to determine whether or not a company has enough resources to fulfill its obligations that are due within a year. The current ratio is a very similar liquidity indicator, which we described in the current ratio calculator. A quick ratio above 1.0 indicates a company has enough quick assets to cover its current liabilities.

The Quick Ratio is a more conservative measure of liquidity. The quick ratio tells you how easily a company can meet its short-term financial obligations. A higher ratio indicates a more liquid company while a lower ratio could be a sign that the company is having liquidity issues. Quick ratios aren’t just valuable to external stakeholders. They also play a vital role in internal decision-making processes. A quick ratio of 2, as calculated above, indicates that the company has twice as many easily liquidated assets as it has short-term liabilities.

Higher ratios indicate a more liquid company while lower ratios could be a sign that the company is having liquidity issues. A ratio greater than 1 indicates that a company has enough assets that can be quickly sold to pay off its liabilities. Quick assets refer to assets that can be converted to cash within one year (or the operating cycle, whichever is longer). It is mostly used by analysts in analyzing the creditworthiness of a company or assessing how fast it can pay off its debts if due for payment right now. These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”).

Due to different characteristics, some industries may have an average quick ratio that seems high or low. Also, if there are other businesses that may be affected in case of bankruptcy, then this could impact whether any claims would be paid back in full or just partially. The same is true for contingent liabilities such as tax filings and litigation matters. It only considers readily available assets and may not take into account other factors such as future prospects, timing of transactions, etc. When you leave a comment on this article, please note that if approved, it will be publicly available and visible at the bottom of the article on this blog.

Often referred to as the ‘Acid-Test Ratio,’ this metric offers insights into a company’s ability to meet short-term obligations. Whether you’re a seasoned investor or a budding entrepreneur, the Quick Ratio is a crucial tool in your financial arsenal. The quick ratio is also fairly easy and straightforward to calculate. It’s relatively easy to understand, especially when comparing a company’s liquidity against a target calculation such as 1.0. The quick ratio can be used to analyze a single company over a period of time or can be used to compare similar companies. On the other hand, a company could negotiate rapid receipt of payments from its customers and secure longer terms of payment from its suppliers, which would keep liabilities on the books longer.